Loan Action : Closure

Closure

The Synofin API's Loan Closure Action is linked to various closure that a user may initiate in accordance with their requirements. This feature involves different step which are :

GET ClosureThis API is used for retrieving all the closure details for the specified Loan Id.

URL: {{base_url}}/loan-management/v1/service-request/status

Request

Request Type : GET

Authorization: Bearer Token

Key Data Type Value

request*

String

Fixed = closure

loanId*

Integer

-

Response: 200

{

Fetch Data for Closure Upon fetching the SynoFin losure API. The user can choose the closure they must carry out in order to fulfil their demand at this point.

POST Data For Loan ActionTo obtain data for closure, utilise this API.

URL: {{base_url}}/loan-modification/v1/service-request/getDataForLoanActions

Request Type : POST

Authorization: Bearer Token

Query Parameter

No parameter

Loan Actions - Closure

Request Body

Response: 200

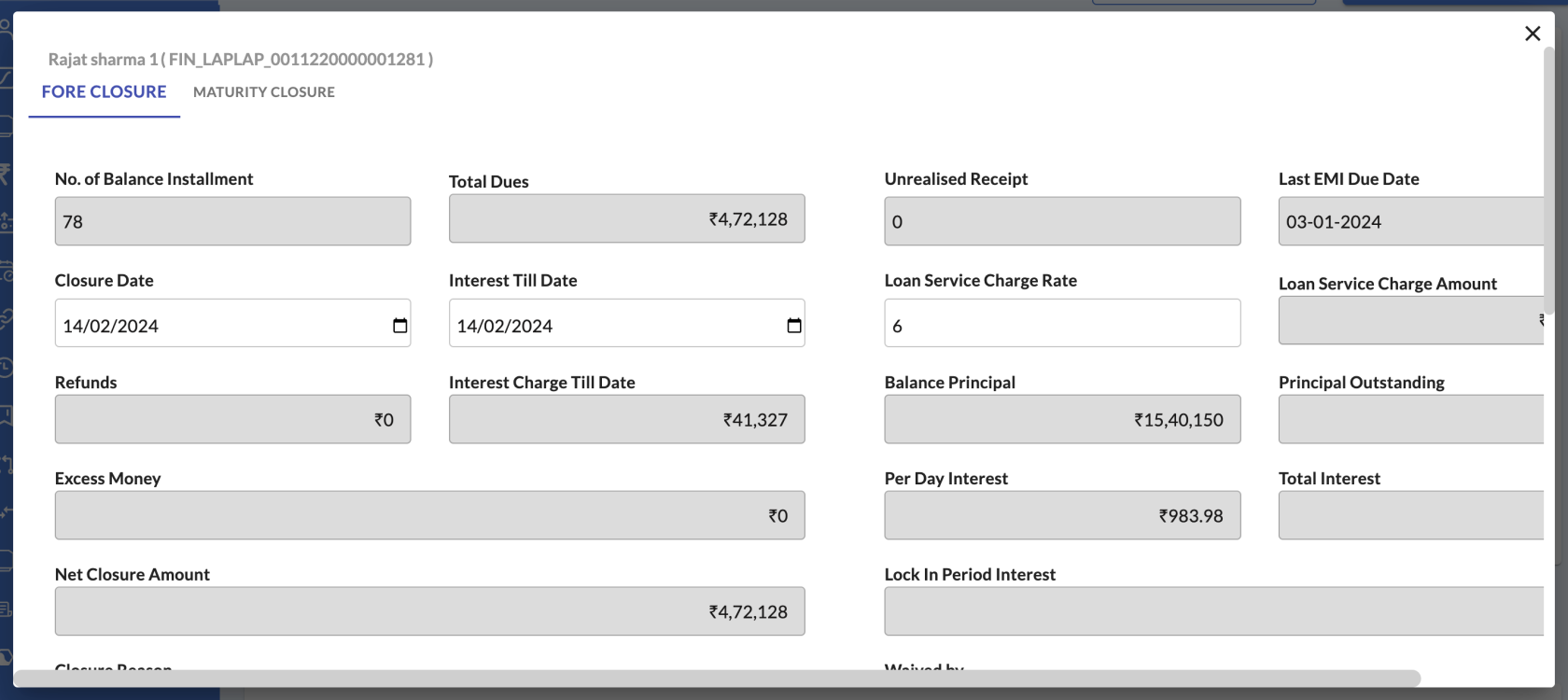

Fore Closure

{

{

Maturity Closure

{

{

POST Master Data for ClosureTo obtain Master data for closure, utilise this API.

URL: {{base_url}}/loan-management/v1/getMasterType

Request Type : POST

Authorization: Bearer Token

Query Parameter

No parameter

Loan Actions - Closure

Request -

Request Body

Response: 200

Fore Closure

[

{

Maturity Closure

[

{

Saving / Initiation Request for Loan Action (Closure) These are the APIs that are used to save loan closure or initiate service requests initiated by maker so that the checker can review them and then determine what they want to accomplish and either Approve or Reject the Request.

Consequently, we use following APIs to save or intiated the Loan Closure for the selected closure for the specified Loan Id.

POST Save Service RequestTo save data for Cancellation, utilise this API.

URL: {{base_url}}/loan-modification/v1/service-request/save

Request Type : POST

Authorization: Bearer Token

Query Parameter

No parameter

Loan Actions - Closure

Request Body

Response: 200

Fore Closure

{, { "charge_code": "total_interest_outstanding", "waiver": "0" }

{

Maturity Closure

{

}, { "charge_code": "total_interest_outstanding", "waiver": "0"

{

Request Approval / Rejection The request must now be approved at the Request page, where users may examine requests and take action.

Click on the link below for knowing more about how request work's