Loan Action : Payment

Payment

The Synofin API's Loan Payment Action is linked to various closure that a user may initiate in accordance with their requirements. This feature involves different step which are :

Retrieving Cancellation (Payment)Retrieving Data for Loan Action (Payment)Saving / Initiation Request for Loan Action (Payment)Approving / Rejection Service Request for Loan Action (Payment)

GET Payment

This API is used for retrieving all the Payment details for the specified Loan Id.

URL: {{base_url}}/loan-management/v1/service-request/status

Request

Response: 200

Fetch Data for Payment

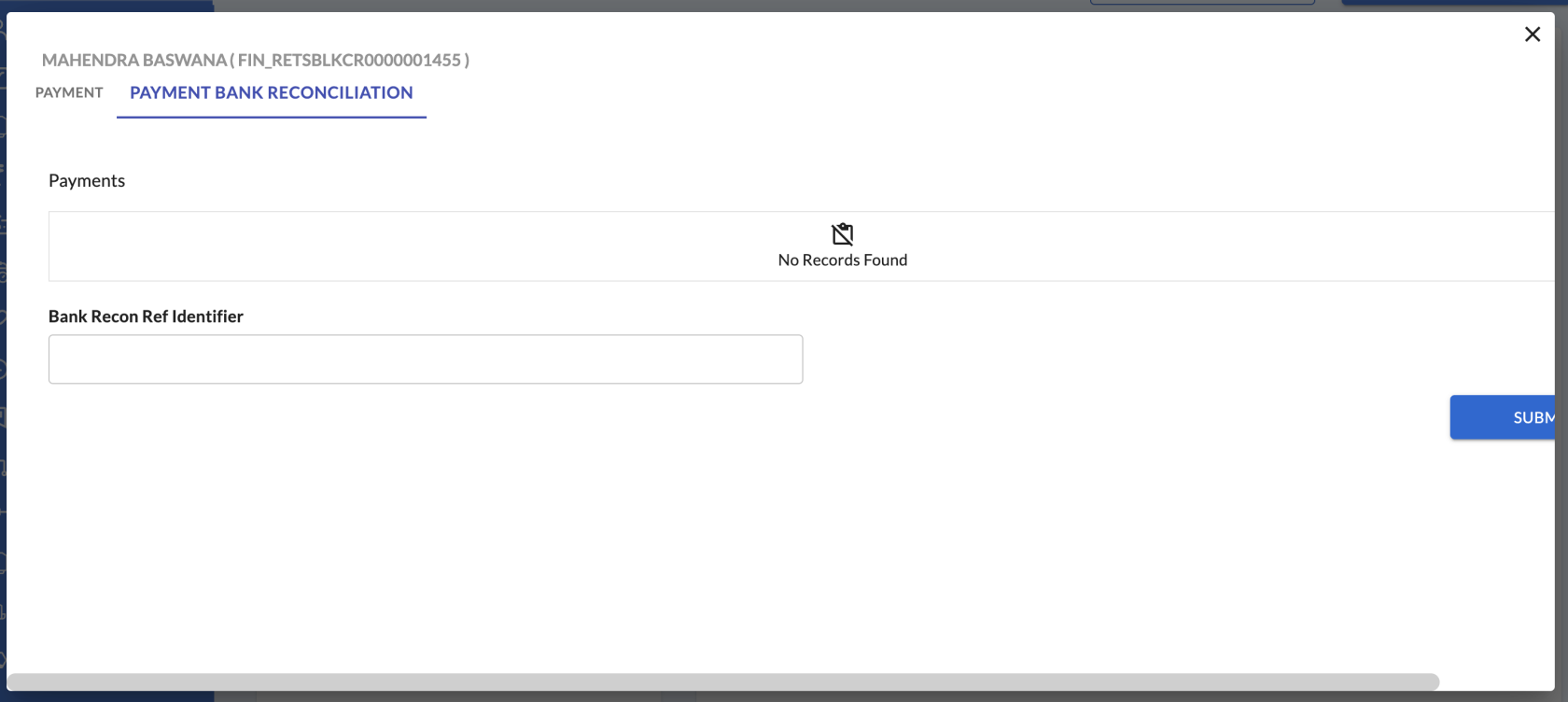

Upon fetching the SynoFin API. The user can choose the Payment they must carry out in order to fulfil their demand at this point. Consequently, we use following APIs to retrieve the Data for the selected Payment for the specified Loan Id.

POST Data For Loan Action

To obtain data for Payment, utilise this API.

URL: {{base_url}}/loan-modification/v1/service-request/getDataForLoanActions

POST Master Data for Payment

To obtain Master data for Payment, utilise this API.

URL: {{base_url}}/loan-management/v1/getMasterType

Saving / Initiation Request for Loan Action (Payment)

These are the APIs that are used to save loan Payment or initiate service requests initiated by maker so that the checker can review them and then determine what they want to accomplish and either Approve or Reject the Request.

Consequently, we use following APIs to save or intiated the Loan Payment for the selected Payment for the specified Loan Id.

POST Save Service Request

To save data for Payment, utilise this API.

URL: {{base_url}}/loan-modification/v1/service-request/save

Request Approval / Rejection

The request must now be approved at the Request page, where users may examine requests and take action.

Click on the link below for knowing more about how request work's