Loan Action : Payment

POST Payment Creation

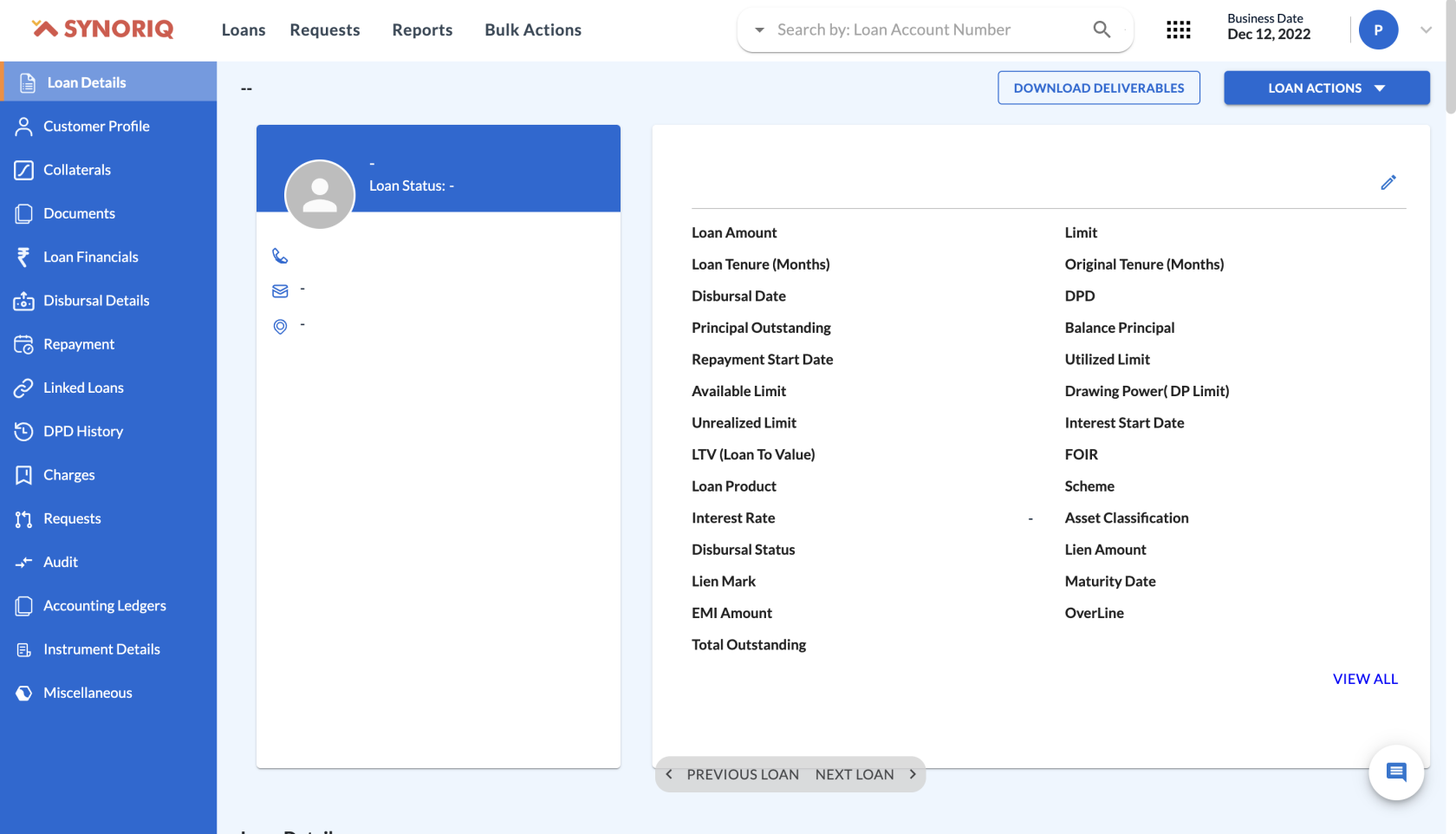

This SynoFin API retrieves all the essential loan information using this Loan Viewer API using Loan Id.

URL: {{base_url}}/loan-management/v1/getBasicLoanDetails

Run in Postman: GET Loan Basic Details

Request:

| Key | Data Type | Description | Validations | Default Value | Required |

| loanId | Integer | Unique identity constraint | N/A | - | Yes |

Response:

Success: 200 OK

Schema

| Attribute |

Type | Description | Mandatory | |

| response |

String | Internal status code that denotes the status of request | Yes | |

| data |

Object Data |

Object | Response Object for the given inputs | Yes |

|

dpd |

Integer | No of Day Past Due for the Loan | Yes | |

|

|

String | Applicant Email Address | Yes | |

|

address |

String | Applicants Complete Address | Yes | |

|

tenure |

Integer | Loan Tenure or Loan period |

Yes |

|

|

foir |

Double | Fixed Obligation to Income Ratio (FOIR) is the eligibility of the applicant | Yes | |

|

source_application_number |

String | Unique loan identity received from the source | Yes | |

|

dealer_id |

integer | Unique Id constraint for Asset dealer | Yes | |

|

loan_application_id |

String | Unique Loan identification for the clients | Yes | |

|

interest_rate |

Double | Applied interest rate for the loan | Yes | |

|

original_tenure |

integer | Initial tenure for the loan | Yes | |

|

ltv_ratio |

Interger | Loan to Value or loan against Collateral | Yes | |

|

loan_amount |

Interger | Loan Amount that is issued | Yes | |

|

loan_tenure |

Interger | Loan Tenure or the Loan duration | Yes | |

|

installments_paid |

Interger | Number The installment that are paid for by the customer | Yes | |

|

loan_marking |

Loan tag if applicable | Yes | ||

|

installment_amount |

Interger | Yes | ||

|

principal_outstanding |

Interger | Yes | ||

|

customer_name |

String | Yes | ||

|

phone_no |

Interger | Yes | ||

|

is_whatsapp_no |

Interger | Yes | ||

|

advance_installment_count |

Interger | Advance Installment paid by the customer | Yes | |

|

advance_installment_amount |

Interger | Yes | ||

|

total_overdue |

Interger | Yes | ||

|

emi_due |

Interger | Yes | ||

|

other_charges |

Interger | Yes | ||

|

disbursed_by |

String | Yes | ||

|

source_application_identifier |

String | Yes | ||

|

product |

String | Yes | ||

|

scheme |

String | Yes | ||

|

loan_type |

String | Yes | ||

|

loan_application_number |

String | |||

|

balance_principal |

||||

|

interest_rate_monthly |

||||

|

no_of_disbursement |

||||

|

customer_id |

||||

|

lending_rate |

Rate of Interest against loan | |||

|

scheme_lending_rate |

||||

|

emi_amount |

||||

|

utilized_limit |

Limit utilized by the client against sanctioned amount | |||

|

dsa_name |

||||

|

unrealized_limit_amount |

Limit that is not initiated | |||

|

applied_amount |

||||

|

branch_manager |

||||

|

sourcing_channel |

||||

|

risk_category |

||||

|

sourcing_channel_type |

||||

|

pd_location |

Applicant location for the asset classification | |||

|

account_classification |

||||

|

drawing_power |

||||

|

lien_mark |

The borrower has permitted the lender to do so in accordance with the recovery of money associated with the mutual fund. | |||

|

lien_amount |

Locked or frozen amount available in your account that is not accessible for a specific time frame | |||

|

tos |

||||

|

debit_freeze |

||||

|

total_freeze |

||||

|

pemi_count |

||||

|

loan_net_worth |

||||

|

start_principle_recovery |

||||

|

caf_number |

Customer application form number | |||

|

no_of_cheque_bounce |

||||

|

dealer_code |

||||

|

advance_interest |

||||

|

advance_emi |

||||

|

advance_emi_payment_mode |

||||

|

advance_interest_payment_mode |

||||

|

total_moratorium_count |

||||

|

next_emi_amount |

||||

|

grace_period |

||||

|

delinquency |

||||

|

moratorium_period |

||||

|

advance_amount_recovery_type |

||||

|

total_nach_bounce_count |

||||

|

total_count_of_repayment |

||||

|

whatsapp_no |

||||

|

aggregated_ltv |

||||

|

overline_amount |

||||

|

total_number_of_bounce_count |

||||

|

moratorium_type |

||||

|

moratorium_months |

||||

|

loan_purpose |

||||

|

account_type |

||||

|

remarks |

||||

|

customer_branch |

||||

|

customer_profile |

||||

|

disbursal_status |

||||

|

sourcing_rm |

||||

|

loan_status |

||||

|

credit_manager |

||||

|

sourcing_branch |

||||

|

disbursal_date |

||||

|

maturity_date |

||||

|

asset_classification |

||||

|

tenure_convention |

||||

|

interest_start_date |

||||

|

repayment_start_date |

||||

|

repayment_mode |

||||

|

disbursed_start_date |

||||

|

disbursed_final_date |

||||

|

agreement_date |

||||

|

string_interest_rate |

||||

|

string_interest_rate_monthly |

||||

|

rate_type |

||||

|

total_limit |

||||

|

remaining_limit |

||||

|

login_date |

||||

|

total_due_amount |

||||

|

irr |

||||

|

balance_tenure |

||||

|

recovery_type |

||||

|

recovery_sub_type |

||||

|

relationship_with_applicant |

||||

|

customer_nationality |

||||

|

segement |

||||

|

offer_amount |

||||

|

partial_tenure |

||||

|

subvention_amount |

||||

|

over_line |

||||

|

partner |

||||

|

subvention_tax_amount |

||||

|

subvention_type |

||||

|

state_head |

||||

|

branch_hierarcy |

||||

|

cost_of_asset |

||||

|

product_type |

||||

|

customer_irr |

||||

|

over_due |

Double | Overdue amount for the loan if applied | Yes | |

|

sourcing_rm_name |

String | Full Namr of the Sourcing Regional Manager | Yes | |

|

sourcing_supervisor |

String | Full name of the Sourcing Supervisor | Yes | |

|

cancellation_date |

Date | Loan cancellation date | Yes | |

|

loan_closure_date |

Date | Loan Closing date | Yes | |

|

dpd_effective_date |

Date |

Date starting for DPD | ||

|

agreed_amount |

Double | Loan Sanction amount | Yes | |

| error |

Object | Internal error object for the given inputs | No | |

Body

{

"response": true,

"data": {

"dpd": 0,

"email": "string",

"address": "string",

"tenure": 0,

"foir": 0,

"source_application_number": "string",

"dealer_id": null,

"loan_application_id": 0,

"interest_rate": 0,

"original_tenure": 0,

"ltv_ratio": 0,

"loan_amount": 0,

"loan_tenure": 0,

"installments_paid": 0,

"loan_marking": [],

"installment_amount": 0,

"principal_outstanding": 0,

"customer_name": "string",

"phone_no": "string",

"is_whatsapp_no": null,

"advance_installment_count": 0,

"advance_installment_amount": 0,

"total_overdue": 0,

"emi_due": 0,

"other_charges": 0,

"disbursed_by": null,

"source_application_identifier": null,

"product": "string",

"scheme": "string",

"loan_type": null,

"loan_application_number": "string",

"balance_principal": 0,

"interest_rate_monthly": null,

"no_of_disbursement": 0,

"customer_id": 0,

"lending_rate": null,

"scheme_lending_rate": null,

"emi_amount": 0,

"utilized_limit": 0,

"dsa_name": null,

"unrealized_limit_amount": null,

"applied_amount": null,

"branch_manager": "",

"sourcing_channel": null,

"risk_category": null,

"sourcing_channel_type": null,

"pd_location": null,

"account_classification": "",

"drawing_power": 0,

"lien_mark": "string",

"lien_amount": 0,

"tos": 0,

"debit_freeze": "No",

"total_freeze": "No",

"pemi_count": 0,

"loan_net_worth": null,

"start_principle_recovery": true,

"caf_number": null,

"no_of_cheque_bounce": 0,

"dealer_code": null,

"advance_interest": null,

"advance_emi": null,

"advance_emi_payment_mode": null,

"advance_interest_payment_mode": null,

"total_moratorium_count": 0,

"next_emi_amount": null,

"grace_period": null,

"delinquency": null,

"moratorium_period": null,

"advance_amount_recovery_type": null,

"total_nach_bounce_count": 0,

"total_count_of_repayment": 0,

"whatsapp_no": null,

"aggregated_ltv": null,

"overline_amount": 0,

"total_number_of_bounce_count": 0,

"moratorium_type": null,

"moratorium_months": null,

"loan_purpose": null,

"account_type": null,

"remarks": null,

"customer_branch": null,

"customer_profile": "",

"disbursal_status": "string",

"sourcing_rm": null,

"loan_status": "string",

"credit_manager": null,

"sourcing_branch": "string",

"disbursal_date": "dd/MM/yyyy",

"maturity_date": "dd/MM/yyyy",

"asset_classification": null,

"tenure_convention": null,

"interest_start_date": "dd/MM/yyyy",

"repayment_start_date": "dd/MM/yyyy",

"repayment_mode": "DRE",

"disbursed_start_date": "dd/MM/yyyy",

"disbursed_final_date": "dd/MM/yyyy",

"agreement_date": "dd/MM/yyyy",

"string_interest_rate": "String",

"string_interest_rate_monthly": "string",

"rate_type": null,

"total_limit": null,

"remaining_limit": 0,

"login_date": null,

"total_due_amount": 0,

"irr": 0,

"balance_tenure": 0,

"recovery_type": null,

"recovery_sub_type": "0",

"relationship_with_applicant": null,

"customer_nationality": null,

"segement": null,

"offer_amount": null,

"partial_tenure": null,

"subvention_amount": null,

"over_line": null,

"partner": null,

"subvention_tax_amount": null,

"subvention_type": null,

"state_head": "",

"branch_hierarcy": null,

"cost_of_asset": 0,

"product_type": "string",

"customer_irr": 0,

"over_due": null,

"sourcing_rm_name": null,

"sourcing_supervisor": null,

"cancellation_date": null,

"loan_closure_date": "dd/MM/yyyy",

"dpd_effective_date": null,

"agreed_amount": 0

},

"error": null

}Status Code: 400 BAD REQUEST

Schema

| Attribute |

Type | Description | Mandatory | |

| response |

String | Internal status code that denotes the status of request | Yes | |

| data |

Object | Response Object for the given inputs | No | |

| error | Object Data | Object | Internal error object for the given inputs | Yes |

| code | integer | Internal error code for API | Yes | |

| text | String | Error message for the API | No | |

| detail | String | Reason / Detail for the cause of error | No | |

Body

Expected messages as per Status API :

| Error Code | Description |

| 107001 | An Exception occurred in saving data |

{

"response": false,

"data": null,

"error": {

"code": 0,

"text": "string",

"detail": "string"

}

}Unauthorized: 401

Note: If the API is not authorized with the Token or if the authorization token has expired, this error is going to show up.

Body

{

"code": 401,

"message": "auth fail, you can retry!"

}