Loan Action : Payment Request

POST Payment Creation

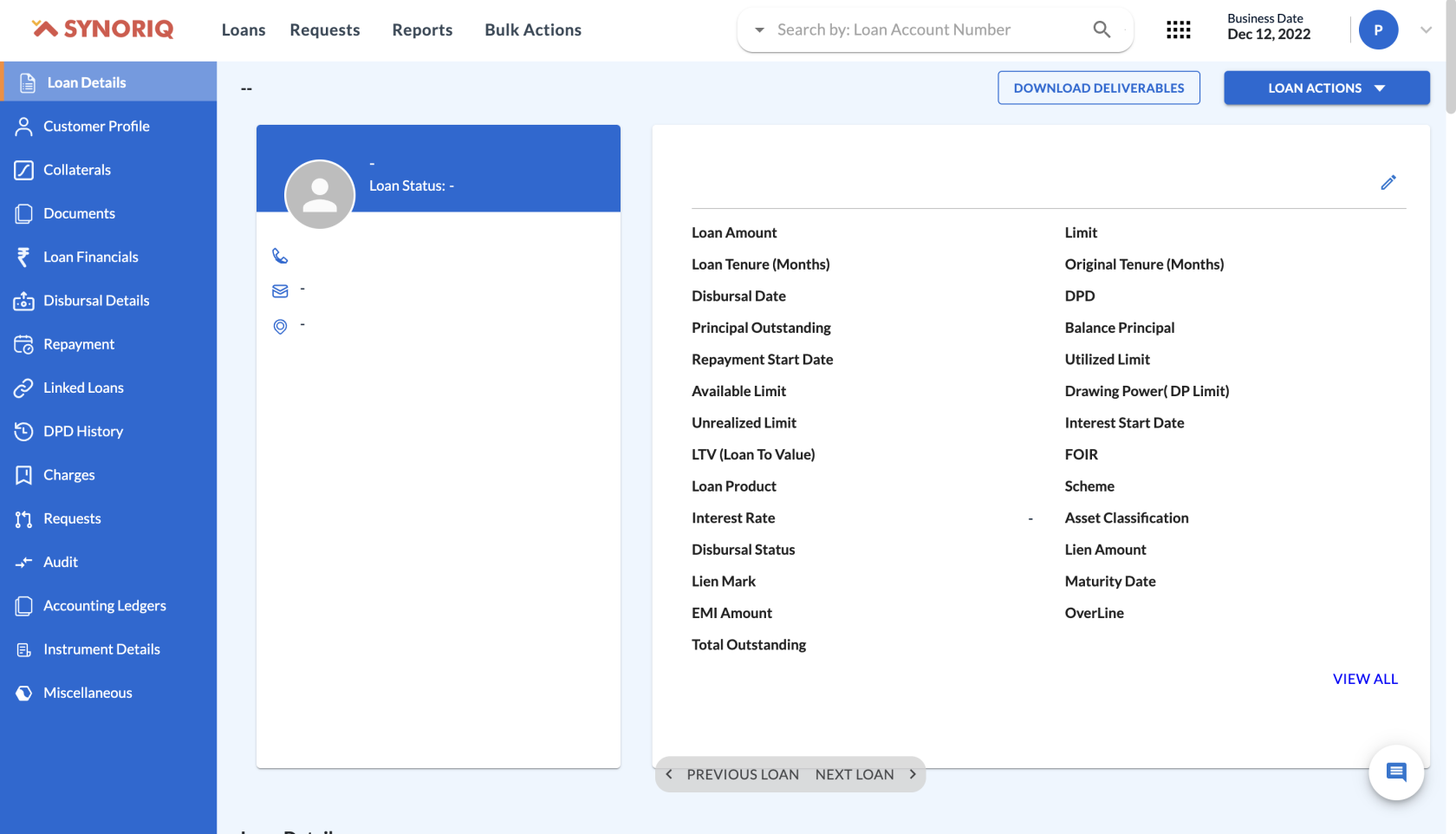

This SynoFin API retrieves all the essential loan information using this Loan Viewer API using Loan Id.

URL: {{base_url}}/loan-management/modification/v1/getBasicLoanDetailsservice-request/save

Run in Postman: GETSave LoanPayment BasicRequest Details

Request:

Request Body Attribute Description

This table includes the Attributes fetched using the Payment Request and offers a thorough view of the attribute, such as default Value, Mandatory, and Data Value, for the API's convenience.

JSON Decription

| Description | Default Value | Mandatory | |

| service_request_type | Action to be perform by Service Request | payment | Yes |

| service_request_subtype | Subtype or action type fetched from master | - | Yes |

| loan_id | Unique Identification Key | - | Yes |

| - paid_to | Beneficiary User id fetched by Master | - | Yes |

| - payment_mode | Mode of Payment (Cash, Cheque, etc) Fetched from Masters | - | Yes |

| - payment_account | Account number of from which transaction need to be initiated | - | Yes |

| - payment_date | Date of payment (yyyy-MM-dd) | - | No |

| - payment_amount | Amount need to be paid | 0 | No |

| - inFavourOf | Amount to be received in Favour of | - | No |

| - transaction_date | Date of Transaction (yyyy-MM-dd) | - | No |

| - payment_bank | Payment bank Id fetched from Maters | - | Yes |

| - fund_transfer_number | UTR no. | - | No |

| - bank_recon_ref_identifier | Bank Identifies | - | No |

| - instrument_date | Date of instrument (Cheque, Demand Draft) | - | No |

| - instrument_number | Instrument Number (Cheque, Demand Draft) | - | No |

| - beneficiary_account_type | Type of beneficiary Account (Cash Credit, Current Account) fetched from masters | - | Yes |

| - beneficiary_account_number | Beneficiary Account Number | - | Yes |

| - ifsc | Bank IFSC code | - | Yes |

| - uploadFile | Reference File for the payment | - | Yes |

| - - charge_id | Unique Id for Charge Need to added in Master | - | Yes |

| - - charge_label | Charge label Fetch by charge_id from Masters | - | No |

| - - total_outstanding_amount | Outstanding Amount | 0 | No |

| - - type | Type of charge amount | - | No |

| - - original_amount | Original Amount | 0 | No |

| - - disbursal_schedule_id | Unique Disbursal Schedule Id | - | Yes |

| - - outstanding_amount | Total Outstanding Amount | 0 | No |

| - - amount_in_process | Amount to be used in Process | 0 |

No |

| - - payment_status | Payment Status fetched from masters | - | No |

| - - paid_amount | Paid amount | 0 | No |

| - - total_paid_amount | Total Paid Amount | 0 | No |

| - - total_paid_amount_in_process | - | - | No |

| - - paid_amount_in_process | - | - | No |

| - - allocated_amount | Allocated Amount to the payables | 0 | Yes |

| - - reason | - | - | No |

| - - payment_date | Date of Payment (yyyy-MM-dd) | - | Yes |

| - - balance_payable | Remaining amount to be paid | - | No |

| - remarks | - | No | |

| service_request_id | Unique Id generated by System post Request is generated (For System Use) | No |

Response:

Schema

| ||||||

|

|

||||||

| ||||||

| ||||||

|

|

|||||

|

||||||

|

||||||

|

||||||

|

||||||

|

||||||

|

||||||

|

||||||

|

||||||

|

||||||

|

||||||

|

||||||

|

||||||

|

||||||

|

||||||

|

||||||

|

||||||

|

||||||

|

||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| uploadFile |

|||||

|

[{ |

|||||

|

number($bigserial) |

|||||

|

string |

|||||

|

number($double) |

|||||

|

string |

|||||

|

number($double) |

|||||

|

number($bigserial) |

|||||

|

number($double) |

|||||

|

number($double) |

|||||

|

string |

|||||

|

number($double) |

|||||

|

number($double) |

|||||

|

number($double) |

|||||

|

number($double) |

|||||

|

number($double) |

|||||

|

string |

|||||

|

(yyyy-MM-dd) |

|||||

|

number($double) |

|||||

| }] |

|||||

| remarks |

|||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

|

| |||||

| ||||||

Body

{

"response"service_request_type": true,"payment",

"data"service_request_subtype": "2",

"service_type": "",

"loan_id": 0,

"request_data": {

"dpd"paid_to": 0,

"email"payment_mode": "string",

"address"payment_account": "string",

"tenure"payment_date": "2024-09-14",

"payment_amount": 0,

"foir": 0,

"source_application_number"inFavourOf": "string",

"dealer_id"transaction_date": null,

"loan_application_id": 0,

"interest_rate": 0,

"original_tenure": 0,

"ltv_ratio": 0,

"loan_amount": 0,

"loan_tenure": 0,

"installments_paid": 0,

"loan_marking": []2024-09-14",

"installment_amount"payment_bank": 0,"1",

"principal_outstanding": 0,

"customer_name"fund_transfer_number": "string",

"phone_no"bank_recon_ref_identifier": "string",

"is_whatsapp_no": null,

"advance_installment_count": 0,

"advance_installment_amount": 0,

"total_overdue": 0,

"emi_due": 0,

"other_charges": 0,

"disbursed_by": null,

"source_application_identifier": null,

"product"dealer_code": "string",

"scheme"instrument_date": "2024-09-14",

"instrument_number": "number",

"beneficiary_account_type": "string",

"loan_type"beneficiary_account_number": null,"number",

"loan_application_number"payment_account_code": "string",

"balance_principal"ifsc": 0,"string",

"interest_rate_monthly": null,

"no_of_disbursement": 0,

"customer_id": 0,

"lending_rate": null,

"scheme_lending_rate": null,

"emi_amount": 0,

"utilized_limit": 0,

"dsa_name": null,

"unrealized_limit_amount": null,

"applied_amount": null,

"branch_manager"uploadFile": "",

"sourcing_channel"payables": null,[

{

"risk_category": null,

"sourcing_channel_type": null,

"pd_location": null,

"account_classification": "",

"drawing_power"charge_id": 0,

"lien_mark"charge_label": "string",

"lien_amount"total_outstanding_amount": 0,

"tos": 0,

"debit_freeze": "No",

"total_freeze": "No",

"pemi_count": 0,

"loan_net_worth": null,

"start_principle_recovery": true,

"caf_number": null,

"no_of_cheque_bounce": 0,

"dealer_code": null,

"advance_interest": null,

"advance_emi": null,

"advance_emi_payment_mode": null,

"advance_interest_payment_mode": null,

"total_moratorium_count": 0,

"next_emi_amount": null,

"grace_period": null,

"delinquency": null,

"moratorium_period": null,

"advance_amount_recovery_type": null,

"total_nach_bounce_count": 0,

"total_count_of_repayment": 0,

"whatsapp_no": null,

"aggregated_ltv": null,

"overline_amount": 0,

"total_number_of_bounce_count": 0,

"moratorium_type": null,

"moratorium_months": null,

"loan_purpose": null,

"account_type": null,

"remarks": null,

"customer_branch": null,

"customer_profile": "",

"disbursal_status"type": "string",

"sourcing_rm"original_amount": null,0,

"loan_status"charge_definition_id": "number",

"excess_money_id": "number",

"disbursal_schedule_id": 0,

"charge_code": "number",

"outstanding_amount": 0,

"amount_in_process": 0,

"payment_status": "string",

"credit_manager"paid_amount": "number",

"total_paid_amount": "number",

"total_paid_amount_in_process": "number",

"paid_amount_in_process": "number",

"allocated_amount": "number",

"reason": null,

"sourcing_branch"payment_date": "string"2024-09-06",

"disbursal_date": "dd/MM/yyyy",

"maturity_date": "dd/MM/yyyy",

"asset_classification": null,

"tenure_convention": null,

"interest_start_date": "dd/MM/yyyy",

"repayment_start_date": "dd/MM/yyyy",

"repayment_mode": "DRE",

"disbursed_start_date": "dd/MM/yyyy",

"disbursed_final_date": "dd/MM/yyyy",

"agreement_date": "dd/MM/yyyy",

"string_interest_rate": "String",

"string_interest_rate_monthly": "string",

"rate_type": null,

"total_limit": null,

"remaining_limit": 0,

"login_date": null,

"total_due_amount": 0,

"irr": 0,

"balance_tenure": 0,

"recovery_type": null,

"recovery_sub_type": "0",

"relationship_with_applicant": null,

"customer_nationality": null,

"segement": null,

"offer_amount": null,

"partial_tenure": null,

"subvention_amount": null,

"over_line": null,

"partner": null,

"subvention_tax_amount": null,

"subvention_type": null,

"state_head": "",

"branch_hierarcy": null,

"cost_of_asset": 0,

"product_type": "string",

"customer_irr": 0,

"over_due": null,

"sourcing_rm_name": null,

"sourcing_supervisor": null,

"cancellation_date": null,

"loan_closure_date": "dd/MM/yyyy",

"dpd_effective_date": null,

"agreed_amount"balance_payable": 0

}

],

"error"remarks": null""

},

"service_request_id": ""

}Response:

StatusSuccess: Code:200 400 BAD REQUESTOK

Schema

| Attribute |

Type | Description | Mandatory | |

| response |

String | Internal status code that denotes the status of request | Yes | |

| data | ||||

| Object Data | Object | Yes | ||

| integer | No | |||

| status | String | Status of service request | Yes | |

| Reason / Detail for the cause of error | No | |||

| unique_transaction_number | String | Unique Transaction Number | No | |

| error |

String | Internal error object for the given inputs | Yes | |

Body

{

"response": true,

"data": {

"result": null,

"status": "initiated",

"service_request_id": 0,

"unique_transaction_number": null

},

"error": null

}Success: 200 OK (Internal Error)

Body

Expected messages as per Status API :

| Description | Error Message | |

| If JSON Object doesn't have "payment_amount" | ||

| 2 | If JSON Object doesn't have "payment_mode" | Payment Bank cannot be Empty |

| 3 | If payment date After Business date | Payment Date can be on or before Business date |

| 4 | If payment date is before Disbursal Date | Payment Date cannot be less than Disbursal Date. |

| 5 | If allocated amount is greater than outstanding amount |

Allocated amount greater than outstanding amount |

| 6 | If total amount is not equal to total outstanding amount |

Total amount is not equal to total allocated amount |

{

"response": false,

"data": null,

"error": {

"code": 0,

"text": "string",

"detail": "string"

}

}Unauthorized: 401

Note: If the API is not authorized with the Token or if the authorization token has expired, this error is going to show up.

Body

{

"code": 401,

"message": "auth fail, you can retry!"

}