Loan Action : Receipt Creation

POST Receipt Creation

The Synofin API's Loan Receipt Action is linked to various closure that a user may initiate in accordance with their requirements. This feature involves different step which are :

Retrieving Cancellation (Receipt)Retrieving Data for Loan Action (Receipt)Saving / Initiation Request for Loan Action (Receipt)Approving / Rejection Service Request for Loan Action (Receipt)

GET Receipt

This API is used for retrieving all the Receipt details for the specified Loan Id.

URL: {{base_url}}/loan-management/v1/service-request/status

Request

Response: 200

Fetch Data for Receipt

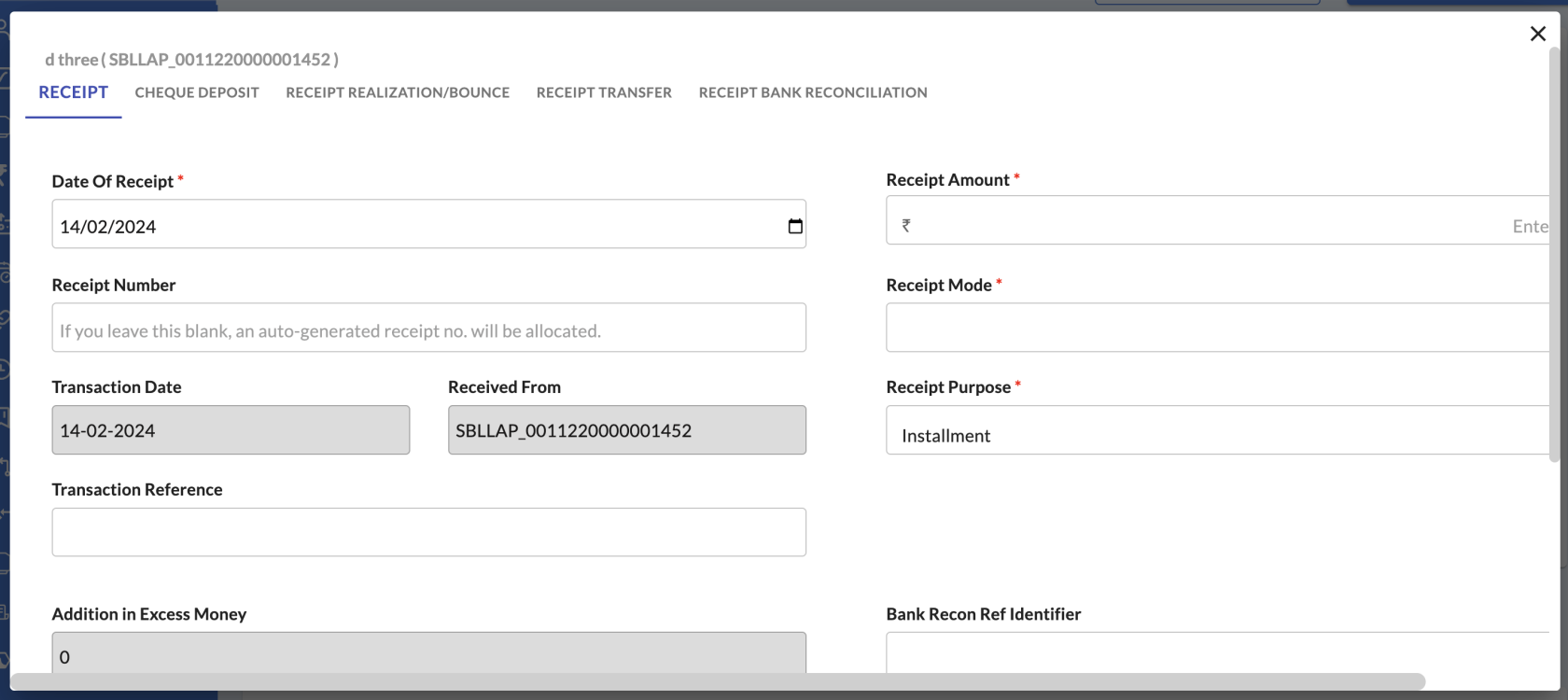

Upon fetching the SynoFin API. The user can choose the Receipt they must carry out in order to fulfil their demand at this point. Consequently, we use following APIs to retrieve the Data for the selected Receipt for the specified Loan Id.

POST Data For Loan Action

To obtain data for Receipt, utilise this API.

URL: {{base_url}}/loan-modification/v1/service-request/getDataForLoanActionssave

Run in Postman: Save Payment Request Details

Request:

POST Master Data for Receipt

To obtain Master data for Receipt, utilise this API.

URL: {{base_url}}/loan-management/v1/getMasterType

Schema

| Attribute | Data Type | Description | Mandatory |

|---|---|---|---|

| loan_id | String | The unique identifier for the loan. | Yes |

| request_data | Object | Contains various details related to the loan receipt request. | Yes |

| addition_in_excess_money | String | Additional amount added beyond the specified limit. | No |

| auto_allocated | String | Indicates whether the amount was auto-allocated. Possible values: "Yes" or "No". | Yes |

| bank_account_number | String | The bank account number for the transaction. | Yes |

| bank_recon_ref_identifier | String | The bank reconciliation reference identifier. | Yes |

| bounce_reason_for_nach | String | Reason for NACH bounce, if applicable. | No |

| cash_receipt_number | String | The cash receipt number. | Yes |

| date_of_receipt | Date | The date when the receipt was generated. | Yes |

| deliverable_charge_code | String | The code for any associated deliverable charge. | No |

| fund_transfer_number | String | The fund transfer number associated with the transaction. | Yes |

| ifsc | String | The IFSC code of the bank. | Yes |

| instrument_bank_address | String | The address of the bank. | Yes |

| instrument_bank_name | String | The name of the bank. | Yes |

| instrument_date | Date | The date mentioned on the instrument (cheque or DD). | Yes |

| instrument_number | String | The number of the instrument (cheque or DD). | Yes |

| is_cheque | Boolean | Indicates whether the payment method is a cheque. | Yes |

| is_nach | Boolean | Indicates whether the payment method is NACH. | Yes |

| loan_application_number | String | The loan application number. | No |

| payment_bank | String | The bank code associated with the payment. | Yes |

| payment_mode | String | The mode of payment (e.g., IMPS, NEFT). | Yes |

| receipt_amount | String | The amount received. | Yes |

| receipt_purpose | String | The purpose of the receipt (e.g., installment, interest). | Yes |

| receipts_allocation | String | Details of any allocation of receipts. | No |

| receivables | Array | An array containing details of receivables. (Can be passed empty) | Yes |

| received_from | String | Identifier of the entity from which payment is received. | Yes |

| remarks | String | Additional remarks or notes. | No |

| sourcing_branch | String | The code of the sourcing branch. | Yes |

| transaction_date | Date | The date of the transaction. | Yes |

| transaction_reference | String | The reference number of the transaction. | Yes |

| upi | String | The UPI ID associated with the transaction. | No |

| service_request_id | String | The ID of the service request. | No |

| service_request_subtype | String | The subtype of the service request. | Yes |

| service_request_type | String | The type of service request. | Yes |

| service_type | String | The type of service. | No |

Body

{

"service_request_type": "receipt",

"service_request_subtype": "2",

"service_type": "",

"loan_id": "000",

"request_data": {

"loan_application_number": "",

"date_of_receipt": "2026-02-03",

"receipt_amount": "12345",

"cash_receipt_number": "CASH123456",

"payment_mode": "cash",

"transaction_date": "2026-02-03",

"received_from": "ACME_LLC",

"receipt_purpose": "installment",

"instrument_date": "2026-02-03",

"instrument_number": "INSTR12345",

"transaction_reference": "REF344",

"payment_bank": "",

"sourcing_branch": "Branch6",

"deliverable_charge_code": "",

"upi": "",

"instrument_bank_name": "Mock Bank",

"bank_account_number": "1234567890",

"fund_transfer_number": "12345678",

"ifsc": "MOCKIFSC123",

"instrument_bank_address": "123 Mock Street, Mock City",

"is_nach": true,

"bounce_reason_for_nach": "",

"addition_in_excess_money": "0",

"bank_recon_ref_identifier": "12345678",

"auto_allocated": "Yes",

"receipts_allocation": "",

"remarks": "This is a mock receipt",

"is_cheque": true

},

"service_request_id": "REQ12345"

}

Response:

Success: 200 OK

Schema

| Attribute | Data Type | Description | Mandatory |

|---|---|---|---|

| response | Boolean | Indicates the success of the request. | Yes |

| data | Object | Contains additional details about the request. | Yes |

| result | Any | Result of the request. | No |

| status | String | Current status of the service request. | Yes |

| service_request_id | Integer | Unique identifier for the service request. | Yes |

| unique_transaction_number | Any | Unique transaction number, if applicable. | No |

| error | Any | Details of any errors, if applicable. | No |

Body

{

"response": true,

"data": {

"result": null,

"status": "initiated",

"service_request_id": 1349,

"unique_transaction_number": null

},

"error": null

}Internal Server Error: 500

Internal Server Error: 200

Schema

Error Response Code and Messages

| S. No | Code | Message | Description |

| 1. |

107373

|

Receipt Reference Number should be Unique

|

Appears When receipt number is similar. |

| 2. |

1015000

|

Invalid LoanApplicationNumber

|

Appears when the loan_id is invalid, null or empty |

| 3. |

1016001

|

Invalid Receipt Amount

|

Appears When receipt amount is empty or null. |

| 4. |

1015000

|

Request already initiated for bank identifier <

bank_recon_ref_identifier

|

Appears If the request is already generated with same

bank_recon_ref_identifier and no action is taken against it.

|

| 5. |

101627

|

Receipt date cannot be before disbursal date. | Appears if the receipt date is after the date of disbursal. |

| 6. | 101754 | Receipt date can be on or before business date | Appears if the receipt date occurs after the business date. |

|

|

Description |

|||||||||||||||

| response |

Boolean | true | Yes | ||||||||||||||

| data |

Object | Fail Response Object |

Yes | ||||||||||||||

|

|

|

Yes | |||||||||||||||

|

|

|

Error

|

|||||||||||||||

| code | Please |

|

|

| |

|

| |

|

|